Married? Common-Law? Find out what happens to your taxes.

May 28, 2021

Whether you’re married or in a common-law relationship, keeping the Canada Revenue Agency (CRA) and if applicable, Revenu Québec, informed of your marital status can help you maximize your benefits while avoiding tax issues down the road.

Here’s a quick rundown of what you should know if you’re married or living common-law, and how your marital status affects your taxes.

I got married! Do I need to tell the CRA and Revenu Québec?

If you’re getting married, you no doubt realize you’re about to embark on one of life’s great adventures. While it’s easy to get swept up in the excitement that comes with this major life change, it’s important to understand how getting married can impact your tax situation.

Both the CRA and Revenu Québec require that you let them know of a change in your marital status by the end of the month following the month it changes. For example, if you get married in October 2020, you’ll have to tell CRA and/or Revenu Québec no later than November 30, 2020.

A change in your marital status can affect the benefits and credits that you can claim on a tax return. Keeping the CRA and Revenu Québec up-to-date will help you maximize any claims you’re entitled to receive, and prevent any incorrect claims from being made that might result in you having to pay money back to the government.

What’s the difference between being married and living common-law?

The rules are slightly different for common-law couples. Married couples can claim their status as soon as they’ve participated in a civil or religious ceremony, regardless of whether or not they’ve been living together. Other couples must be living together for 12 months in a row to be considered common-law for tax purposes. If you have children together, then you’re considered common-law as soon as you begin living together.

If you’re not sure what your marital status is, check out this blog to learn more.

I separated from my spouse or common-law partner. How does this affect my taxes?

If you’re in a common-law relationship, you and your partner need to be apart for at least 90 days to be considered officially separated by the CRA and Revenu Québec. In the year of separation, a claim for the spouse or common-law partner amount is calculated using your partner’s net income before the date of separation, rather than the whole year.

If you got back together within 90 days, there are no tax implications that you need to worry about. However, if you had custody and control over a dependant and you weren’t living with or being supported by your spouse during the separation, you might be able to claim an amount for the eligible dependant.

If you and your spouse are legally married, you’ll only be considered officially separated by the CRA and Revenu Québec if you get divorced – even if you live apart for 90 days. However, there are some credits and deductions you won’t be eligible for anymore if you separated for at least 90 days.

How do I update my relationship status with the CRA?

You can tell the CRA by:

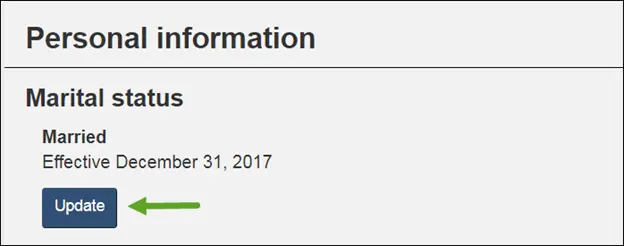

- Logging in to the CRA’s My Account service. Then, under Personal profile, click the Update button located in the Marital status section;

- Calling 1-800-387-1193 to speak to a CRA representative; or

- Completing and mailing-in form RC65: Marital Status Change to the tax centre that assesses your return.

How do I let Revenu Québec know my marital status has changed?

Depending on the benefits you receive, there are different ways to contact Revenu Québec. For example, if you receive child assistance payments, you’ll need to contact Retraite Québec by calling 1-800-667-9625. You can also use Revenu Québec’s Change in Conjugal Status form online.

Are my tax credits or benefits linked to my partner’s income?

It’s important to remember that when you get married or enter into a common-law relationship it could mean that the benefit amounts you’re used to receiving will change. The CRA and Revenu Québec will take into account the total earnings from both spouses to determine which credits and benefits you may be eligible for and who they should be allocated to. For example, if you have childcare expenses, they can only be claimed by the spouse or common-law partner with the lower net income. A change in your marital status can also impact both your Canada Child Benefit (CCB) and your GST/HST payment amounts.

On the bright side, as a spouse or common-law partner, you might be eligible for a number of credits or benefits that could increase your refund, including:

- The spouse or common-law partner amount if you supported your spouse and their net income was less than $13,229 in 2020;

- Combining your medical expenses and charitable donations;

- Contributing to your spouse’s RRSP; and

- Splitting your pension income.

To learn more about a change in your marital status can impact your tax situation, visit the H&R Block Online Help Centre.

Can my partner and I file one return?

According to the Canada Revenue Agency (CRA), both you and your spouse or common-law partner must file your own tax returns. You have the option, however, to prepare your returns separately (uncoupled) or together (as a coupled return).

Preparing your return with your spouse can maximize your tax savings and minimize the amount of taxes you might owe. To learn more about preparing individual and spousal tax returns, visit the H&R Block Online Help Centre.

Ready to file? H&R Block makes sure you Get What’s YoursTM. Get help from the largest network of reliable Tax Experts by choosing one of four convenient ways to file: File in an Office, Drop-off at an Office, Remote Tax Expert, or Do It Yourself Tax Software.